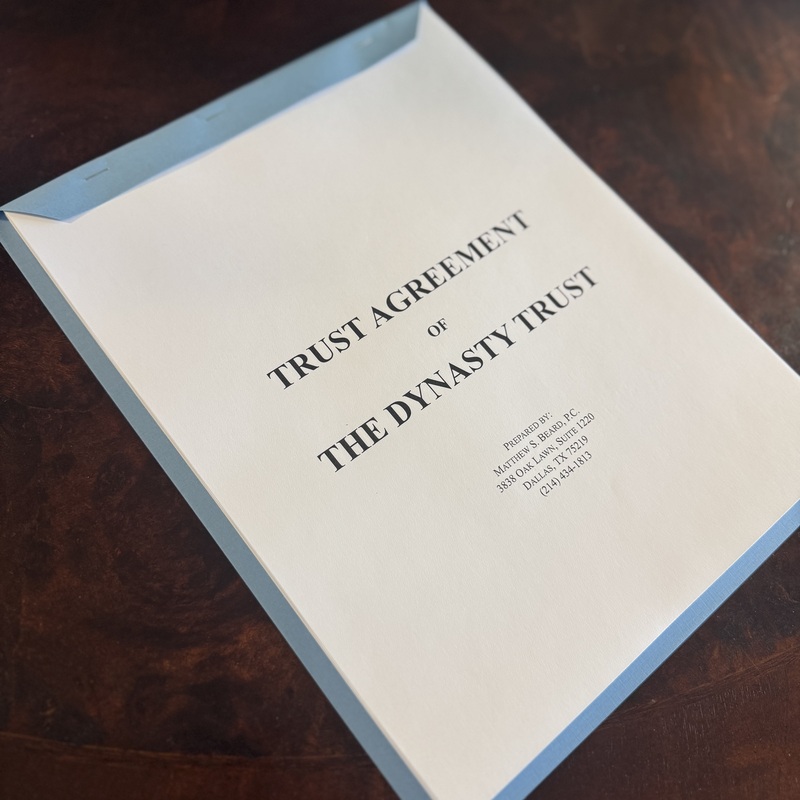

MATTHEW S. BEARD, P.C.

––––––––TAX ATTORNEY––––––––

TAX, ESTATE, TRUST, AND PARTNERSHIP

Legal representation

for the

transfer and taxation

of property

Estates follow a life cycle pattern of growth, maturity, and termination. With proper planning and administration, this cycle occurs over multiple generations.

We work with clients and their advisors on tax and other legal issues for estates, trusts, and partnerships.

I.R.C. § 754 Election and the Ides of March

March 15 is an important deadline for the I.R.C. § 754 election. Executors should beware of the ides of March.

Tax Free Transfers to Spouse

Income, gift, and estate tax are not typically due following the transfer of property to a spouse. The Code contains several favorable rules for transfers to a spouse during life and at death.

Inflation Adjustments for 2026

The Service published Rev. Proc. 2025-32, which sets forth inflation adjusted items for 2026. Increases are beneficial for tax planning.

The Disposition of a Residence

The disposition of a residence receives favorable income tax treatment. I.R.C. § 121 excludes from gross income the gain from a sale of a principal residence, and I.R.C. § 1014 provides a new basis for a residence acquired from a decedent. These provisions potentially permit income tax free appreciation and, thus, encourage investment in a residence. The disposition decision, however, involves multiple paths that lead to different results. This article examines income tax rules that incentivize investment in a residence and the implications of transferring a residence.

The Yoke of a Joint Interest

A joint interest is often used as an estate planning tool to avoid probate. The corresponding tax implications, however, are not favorable. I.R.C. § 2040 generally requires inclusion of the entire value of a joint interest in the gross estate, rather than the decedent’s interest therein. Only exceptions take underlying economics into account, and the executor bears a burden of proof that may prove difficult to meet. This article reviews the tax implications of a joint interest.

Disclaimer Planning: No Coin Toss Needed for Unpredictable Tax Law

A disclaimer provides flexibility in estate planning to address unpredictable tax law, particularly with respect to the basic exclusion amount under I.R.C. § 2010(c) that is in a state of flux. The focus of disclaimer planning is to provide the surviving spouse with an option to arrange for favorable income tax results, such as a new basis under I.R.C. § 1014(a), where no estate tax is due. This article reviews requirements for a qualified disclaimer under I.R.C. § 2518, presents components of a disclaimer trust structure, and analyzes implementation of a disclaimer for small, medium, and large estates. With disclaimer planning, a coin toss is not needed to address unpredictable tax law.

Curing Basis Discrepancy

This two-part article examines three approaches to cure the discrepancy between I.R.C. § 1014 and I.R.C. § 1015, as well as drafting and reporting considerations for the exercise of a grantor's substitution power.

Addressing Tax Liens in Estate Administration

The personal representative of a decedent's estate is subject to a potential risk of personal liability for paying a debt of the estate before paying a claim of the U.S. With proper planning and estate administration, the risk of personal liablity is avoided. This article summarizes the federal priority statute, recurring fact patterns, and options for addressing liens and the risk of personal liability.

Process

The path forward presents both opportunities and pitfalls. The planning process anticipates and addresses them.

Academia

Good advice draws from years of study, teaching, and publications. We are committed to contributing to the academic side of the law.

Treatise

The Internal Revenue Code provides favorable income tax rules that impact all individuals. There is a risk, however, of inadvertently foregoing favorable results. This treatise provides a resource for income tax considerations in estate planning.

Office

The office is located in Turtle Creek Village in Dallas, Texas, minutes from Love Field and downtown.

Matthew S. Beard, P.C.

3838 Oak Lawn, Suite 1220

Dallas, TX 75219

(214) 434-1813